Monthly financial statements are important to use in businesses of all sizes in order to keep your financial house in order. I recommend that at the close of every month you have your in-house accountant or virtual CFO prepare a monthly financial statement reporting package and you review this every month.

At the beginning of this ritual, you may find it a little more difficult, but as time goes on, you will become accustomed to being financially informed and recognize the benefit of knowing what is going on inside of your business.

Knowing your business numbers is essential to being a good business owner. When you know your business numbers you understand how the day-to-day decisions that you are making shape the profitability and longevity of your business.

Monthly financial statement templates can be found on the internet for free, but you want to be sure that you are using a reputable source.

Your monthly financial statement package should include:

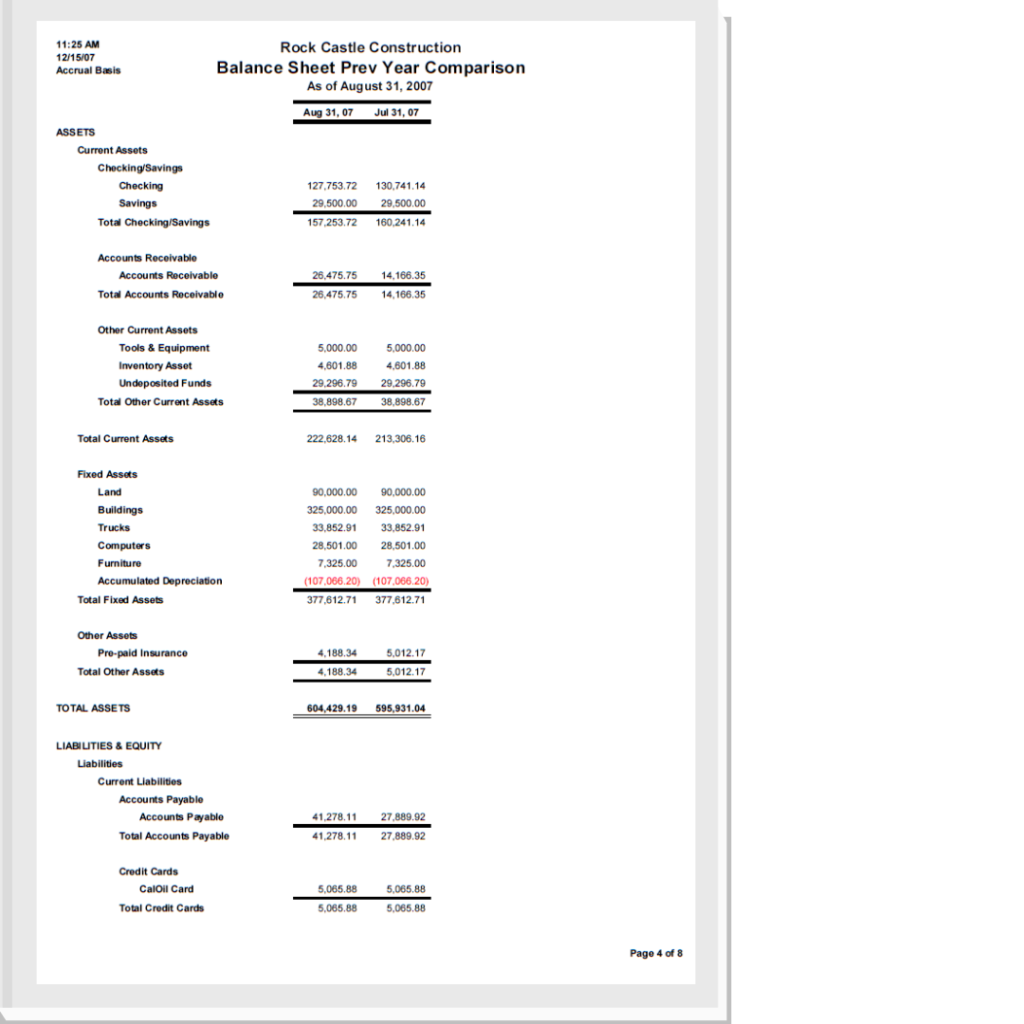

Balance sheet

The balance sheet will reflect the changing value of your business from month to month. A monthly financial statement balance sheet shows what your business would be worth if you were to sell off your assets, pay your bills (liabilities) and what would be leftover is what the business would be worth. That amount would be distributed to the stakeholders of the business.

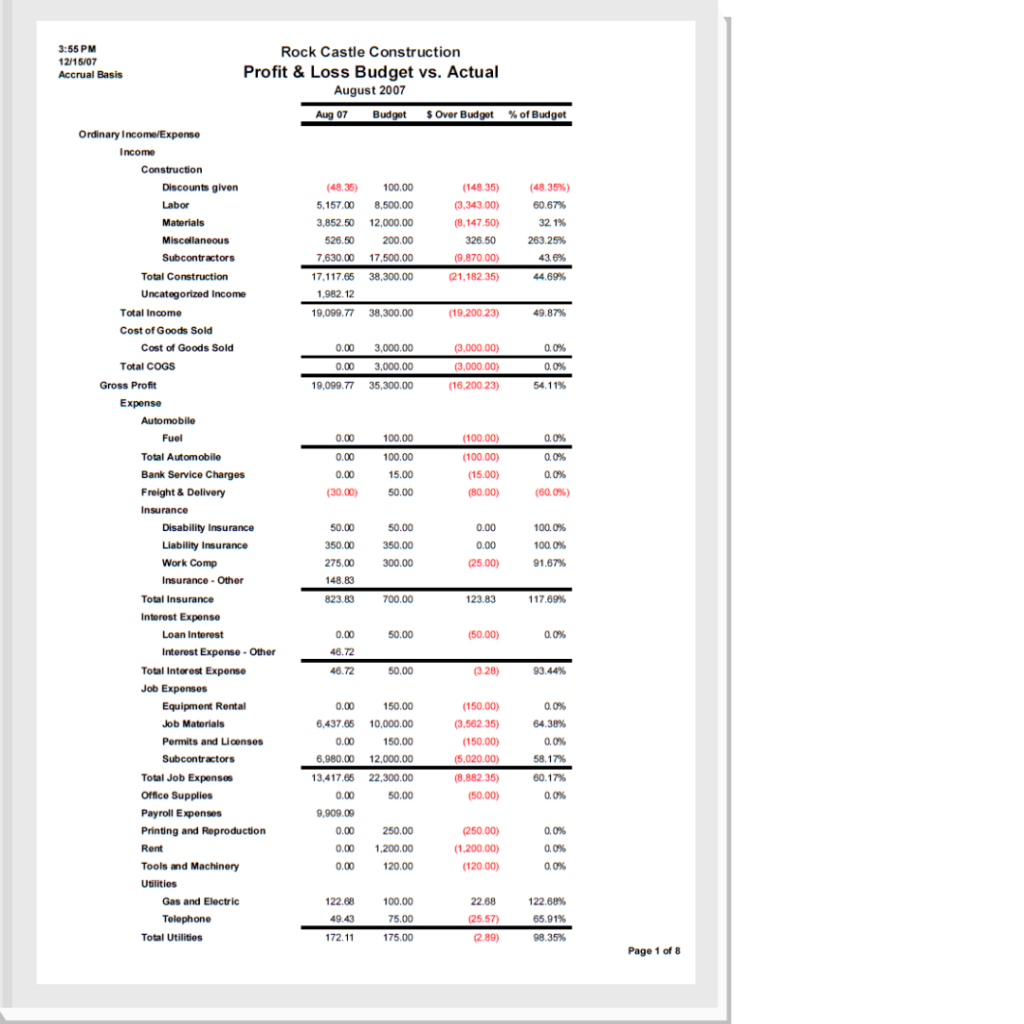

Income statement

The income statement is also known as the profit and loss statement. This monthly financial statement should be printed out on a monthly basis on a year-to-date running report. Every month you should see how profitable your business is. If there are any problems such as money leaks, this gives you the opportunity to analyze and course-correct earlier rather than later.

For your monthly financial statement package, there are several variations of reports you can use. You can run a year-to-date report, a quarterly report, a fiscal report that compares to the prior year’s results, and so many other variations. These are the monthly financial statements that you use to create your financial picture of your business, so if a certain variation of a report brings you value, use it! Make it fun and interesting.

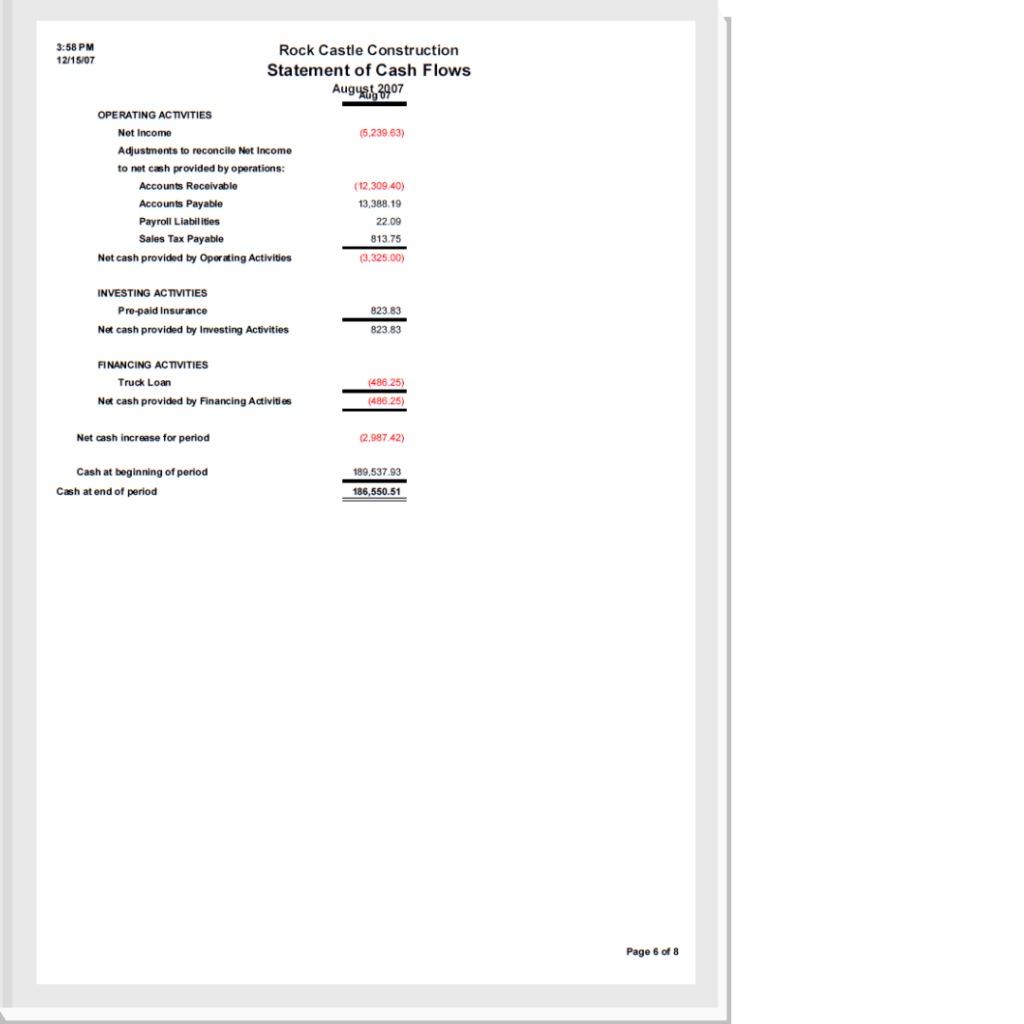

Statement of cash flow

Cash management reporting is essential to manage the cash in your business. Cash will flow in and out of the business on a regular basis, and you need to be aware of the timing issues that these flows cause. Proper planning avoids cash flow fluctuations so be sure to include these monthly financial statements in your reporting package.

Other variations of reports

Monthly financial statements are essential to good business management, so I recommend that you use as many reports that you need to help you make good business decisions.

I really like to use a variation of the income statement that measures what you budgeted against the actuals. When you create an operating budget for the year, you are breaking monthly performance down, and you can measure your performance against what you had planned. It is an effective way to track your monthly expenses and progress.

Monthly financial statements can be generated quickly through Quickbooks

If you are using Quickbooks, you can easily generate your monthly financial statements using this software. Quickbooks also has the ability to let you enter your annual budgets into the system and you can generate your monthly reports with ease. Quickbooks will do all the work for you.

Being a CPA for over 20 years, I have worked with many software programs and I really like using Quickbooks. The program offers different levels and price points, and Quickbooks is software that will grow with your business.

If you are not using a software program, you can use a monthly financial statement template excel package. You can drop your numbers into the excel spreadsheet and it will give you a nice formatted look.

What do I need to know for monthly financial statement packages?

You need an accurate and correct base of financial data, which means that your bookkeeping records must be accurate and timely. You need to have all the financial transactions entered and reconciled before you close the month and run monthly financial statements.

The bookkeeping function is an essential part of your business finances. All your reports are generated from the financial data, so if your data is incorrect, your reports will be too. Make sure your bookkeeper is performed by competent people who understand the accounting rules.

Why do I need to generate a monthly financial statement package?

The monthly financial statement format is very important because it needs to be readable and understandable. This package will offer you a complete understanding of how your business is performing, and the financial health of the business.

You can identify issues before they become bigger money leaks or business problems.

Business owners who know their business numbers set themselves up for success.

Do you want to set up your business for financial success? Sign up for The Confident Cash Method Program to learn how to manage your financial statements. This course covers the four essential steps you need to understand as a business owner: reading monthly financial statements, preparing an annual business plan, monitoring your progress against your plan, and managing your cash flow. This course includes many bonuses as well.